Millions of U.S. households are expected to face financial burdens in the wake of the coronavirus pandemic.

Millions of U.S. households are expected to face financial burdens in the wake of the coronavirus pandemic.

If you are facing reduced hours or job loss and are worried about making your rent or mortgage payment this month, stay calm — President Trump said Wednesday that the Department of Housing and Urban Development will suspend “all foreclosures and evictions” through the end of April.

That said, you will still want to discuss your options with your mortgage lender or landlord if you have experienced a disruption in your income. Here are some steps to take now.

If you are a homeowner

Contact your lender

Financial planners and consumer advocates are encouraging homeowners to reach out to their loan servicer directly to discuss payment options as soon as they can.

“Borrowers should first reach out to their mortgage holder and inquire about resources they have to delay payments,” John Graff, a Los Angeles-based real estate broker, tells CNBC Make It. “Many lenders have implemented special waivers due to COVID-19, you should check with them first.”

Lenders have certain obligations under your mortgage contracts, says Ira Rheingold, executive director of the National Association of Consumer Advocates. If they aren’t willing to work with you, he suggests reporting them to your state attorney general’s office and the Consumer Financial Protection Bureau.

“You’ve got a long-term relationship with them and they have certain obligations under the law,” says Rheingold. “Contacting them before you are behind is a good thing to do.”

Reach out to your bank or credit union

Your bank may also offer hardship programs you can tap into. Don’t wait until your mortgage payment is due to find out about this, call today.

“You have to call and ask about it and most likely apply,” “Don’t wait until your mortgage payment is due to find out about this, call today. Remember that you don’t have to take advantage of these programs, but it’s worth it to know what’s out there.”

If that doesn’t work, we suggest contacting your bank to discuss your personal loan options to continue making payments. “Low rates coupled with mass benevolence from corporate America means you may be able to borrow some cash to help tide you over,”

Many banks are already putting together coronavirus response pages. Here are a few major ones:

Put your loan in forbearance

A less-than-ideal alternative for homeowners is forbearance, a hardship option that allows you to postpone payments.

“The key here is to inquire about options available for a delay in payments under so-called hardship circumstances,” says Mark Hamrick, senior economic analyst at Bankrate.com.

Although this can provide immediate relief, interest will still accrue on your loans. Since you won’t be paying down your principal balance, that means you will likely owe more in the long run because you will owe more in interest than you would if you made regular payments.

If you have to go this route, ask your lender what terms they can offer you. They will be different for each person depending on their financial history and loan provider.

If you are a renter

Give your landlord notice

Renters are advised to contact their landlords as soon as they can to talk through delayed or partial payment options.

“Most landlords would be willing to work with a good tenant who is experiencing hardship due to current events,” says Graff.

Work out a payment plan

It’s best to give your landlord at least a partial payment if you can, says Long. Make a payment plan with them with repayment dates, and get everything in writing. She suggests using the following script and inputting your own financial details:

Hi landlord, as you probably know, I’m off work right now. Will you accept $500 this month rather than the typical $1,000?

If you believe you won’t be able to make a payment at all, bring it up to your landlord as soon as possible and, again, ask if you can put a plan into place to pay once you have income again. Long says to ask if you can skip a month and spread the payment out over the next six months (or whatever is realistic for you) once you are back to work.

“Remember that your landlord needs income too, so approach this with empathy for what you’re asking,” she says. Make clear that “you’re just paying late rather than asking for free money.”

You can also call 211 for your local United Way to see if they are offering rent help, Long suggests.

Look for outside assistance

If your landlord refuses to work out a payment plan, Graff suggests turning to your bank for a short-term loan.

“Many banks are offering to help their customers during this difficult time and you should absolutely take advantage of the assistance if you need it,” he says.

Housing is your top priority

Housing and food should be your top priorities, says Long. After that, take time to figure out what’s going on with your other bills. Both renters and homeowners can check in with creditors and utility companies to see if they are offering financial hardship assistance.

“If your utility company is willing to waive late fees and give you a payment plan with super low interest for your bill, but your internet provider won’t be flexible, you may opt to pay your internet bill before utilities,” she says. “The goal is to minimize the long-term impact of paying late or less than in full.”

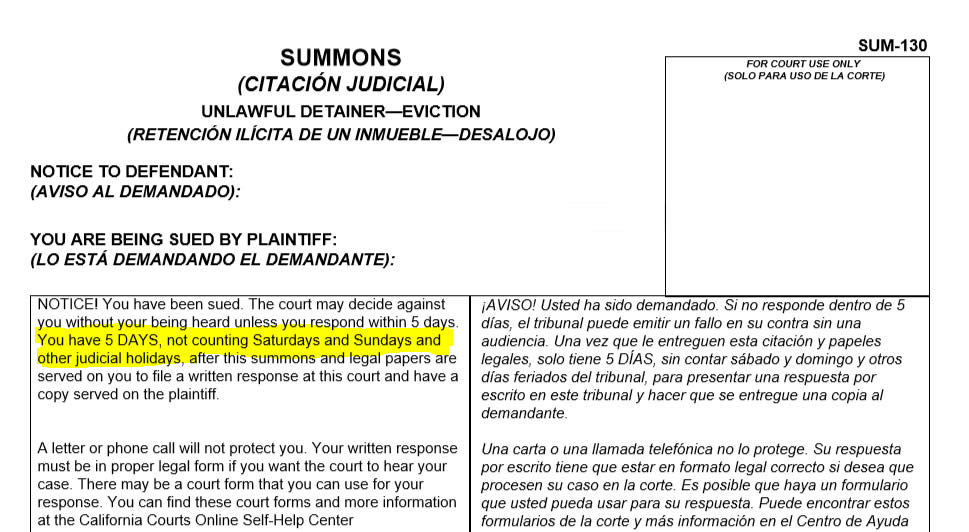

Eviction bans

Before Trump announced that the federal government would take action, many cities and some states said that they would implement 30-day or indefinite eviction bans so that renters cannot be kicked out of their homes during the crisis.

“In Los Angeles, for instance, renters experiencing hardship due to COVID-19 qualify for the eviction moratorium and will have up to six months to repay any unpaid rent,” says Graff. “You should check local and state government websites to see if there are options like this available in your area.”

Other cities and states doing this include Baltimore, Boston, Kansas, Miami, New York state, Portland, Sacramento, San Francisco, San Jose and Seattle.

The Federal Housing Finance Agency has asked mortgage servicers to offer borrowers options to reduce or suspend payments for up to six months, says Jill Fopiano, CEO of Boston-based O’Brien Wealth Partners. She also advises homeowners to consult the CFPB’s Find a Counselor tool, which provides a list of counseling agencies.

Tags: Eviction Information, Landlord Advice, LANDLORDS, TENANTS