Process Service Requirements by State

Below are the Service Process Requirements listed out by state on NationalEvictions Blog. Please note that the below service rules apply to adult individuals who are mentally competent, and not incarcerated, unless otherwise stated. These rules of service do not apply to businesses or corporations. As in everything you do with regards to legal procedures, you should always check your states Judicial Branch website for the most up to date rules. A consultation with an attorney or other legal resource is also recommended if you are ever served a Summons and Complaint.

ALABAMA

Upon an individual, other than a minor or an incompetent person, by serving the individual or by leaving a copy of the summons and the complaint at the individual’s dwelling house or usual place of abode with some person of suitable age and discretion then residing therein or by delivering a copy of the summons and the complaint to an agent authorized by appointment or by law to receive service of process.

ARKANSAS

Upon an individual, other than an infant by delivering a copy of the summons and complaint to him personally, or if he refuses to receive it, by offering a copy thereof to him, or by leaving a copy thereof at his dwelling house or usual place of abode with some person residing therein who is at least 14 years of age, or by delivering a copy thereof to an agent authorized by appointment or by law to receive service of summons. Updated: https://bentoncountyar.gov/circuit-clerk/wp-content/themes/bentoncounty/documents/sites/5/2020/07/Process-Server-Forms-7-15-2020.pdf

ALASKA

Service of all process shall be made by a peace officer, by a person specially appointed by the Commissioner of Public Safety for that purpose or, where a rule so provides, by registered or certified mail.

ARIZONA

Service upon an individual from whom a waiver has not been obtained and filed shall be effected by delivering a copy of the summons and of the pleading to that individual personally or by leaving copies thereof at that individual’s dwelling house or usual place of abode with some person of suitable age and discretion then residing therein or by delivering a copy of the summons and of the pleading to an agent authorized by appointment or by law to receive service of process.

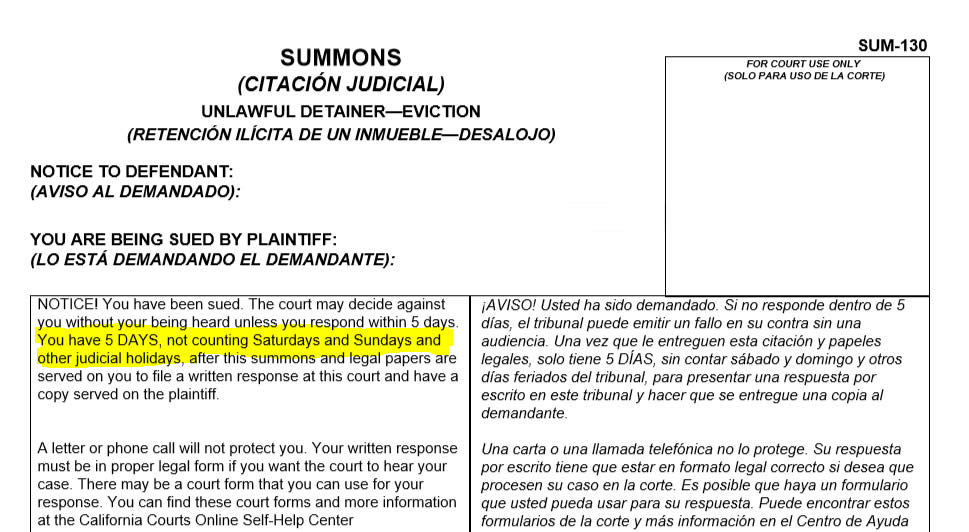

CALIFORNIA

- In lieu of personal delivery of a copy of the summons and of the complaint to the person to be served as specified in Section 416.10, 416.20, 416. 30, 416.40, or 416.50, a summons may be served by leaving a copy of the summons and of the complaint during usual office hours in his or her office with the person who is apparently in charge thereof, and by thereafter mailing a copy of the summons and of the complaint (by first-class mail, postage prepaid) to the person to be served at the place where a copy of the summons and of the complaint were left. Service of a summons in this manner is deemed complete on the 10th day after such mailing.

- If a copy of the summons and complaint cannot with reasonable diligence be personally delivered to the person to be served as specified in Section 416.60, 416.70, 416.80, or 416.90, a summons may be served by leaving a copy of the summons and of the complaint at such person’s dwelling house, usual place of abode, usual place of business, or usual mailing address other than a United States Postal Service post office box, in the presence of a competent member of the household or a person apparently in charge of his or her office, place of business, or usual mailing address other than a United States Postal Service post office box, at least 18 years of age, who shall be informed of the contents thereof, and by thereafter mailing a copy of the summons and of the complaint (by first-class mail, postage prepaid) to the person to be served at the place where a copy of the summons and of the complaint were left. Service of a summons in this manner is deemed complete on the 10th day after the mailing. (Amended by Stats. 1989, Ch. 1416, Sec. 15.)

COLORADO

Upon a natural person over the age of eighteen years by delivering a copy or copies thereof to the person, or by leaving a copy or copies thereof at the person’s usual place of abode, with any person over the age of eighteen years who is a member of the person’s family, or at the person’s usual place of business, with the person’s secretary, bookkeeper, manager, or chief clerk; or by delivering a copy to an agent authorized by appointment or by law to receive service of process.

CONNECTICUT

Process in any civil action shall be served by leaving a true and attested copy of it, including the declaration or complaint, with the defendant, or at his usual place of abode, in this state.

DELAWARE

Upon an individual other than an infant or an incompetent person by delivering a copy of the summons, complaint and affidavit, to that individual personally or by leaving copies thereof at that individual’s dwelling house or usual place of abode with some person of suitable age and discretion then residing therein, or by delivering copies thereof to an agent authorized by appointment or by law to receive service of process.

DISTRICT OF COLUMBIA

Service may be any of the following:

A. personal, including delivery to a responsible person at the office of counsel;

B. by mail;

C. by third-party commercial carrier for delivery within 3 calendar days; or

D. by electronic means, if the party being served consents in writing.

FLORIDA

- Service of original process is made by delivering a copy of it to the person to be served with a copy of the complaint, petition, or other initial pleading or paper or by leaving the copies at his or her usual place of abode with any person residing therein who is 15 years of age or older and informing the person of their contents. Minors who are or have been married shall be served as provided in this section.

- Employers, when contacted by an individual authorized to make service of process, shall permit the authorized individual to make service on employees in a private area designated by the employer.

GEORGIA

To the defendant personally, or by leaving copies thereof at his dwelling house or usual place of abode with some person of suitable age and discretion then residing therein, or by delivering a copy of the summons and complaint to an agent authorized by appointment or by law to receive service of process.

If the person cannot be found, is residing out of state, or is concealing his whereabouts, the court may order service by publication.

HAWAII

Anywhere in the State by the sheriff or the sheriff’s deputy, by some other person specially appointed by the court for that purpose, or by any person who is not a party and is not less than 18 years of age; or In any county by the chief of police or the chief’s duly authorized subordinate.

IOWA

Original notices are served by delivering a copy to the proper person. Personal service may be made as follows: upon any individual who has attained majority who has not been adjudged incompetent either by taking the individual’s signed, dated acknowledgment of service endorsed on the notice; or by serving the individual personally; or by serving, at the individual’s dwelling house or usual place of abode, any person residing therein who is at least 18 years old, but if such place is a rooming house, hotel, club or apartment building, the copy shall there be delivered to such a person who is either a member of the individual’s family or the manager, clerk, proprietor or custodian of such place; or upon the individual’s spouse at a place other than the individual’s dwelling house or usual place of abode if probable cause exists to believe that the spouse lives at the individual’s dwelling house or usual place of abode.

IDAHO

In person, or by fax.

Any summons, writ, order or other paper requiring service may be transmitted by facsimile machine process or telegraph and the copy transmitted may be served or executed by the officer or person to whom sent, and returned in the same manner, and with the same force, effect, authority and liability as the original. The original must be filed in the court from which issued.

ILLINOIS

Except as otherwise expressly provided, service of summons upon an individual defendant shall be made

- by leaving a copy of the summons with the defendant personally,

- by leaving a copy at the defendant’s usual place of abode, with some person of the family or a person residing there, of the age of 13 years or upwards, and informing that person of the contents of the summons, provided the officer or other person making service shall also send a copy of the summons in a sealed envelope with postage fully prepaid, addressed to the defendant at his or her usual place of abode, or

- as provided in Section 1-2-9.2 of the Illinois Municipal Code with respect to violation of an ordinance governing parking or standing of vehicles in cities with a population over 500,000. The certificate of the officer or affidavit of the person that he or she has sent the copy in pursuance of this Section is evidence that he or she has done so.

INDIANA

In General. Service may be made upon an individual, or an individual acting in a representative capacity, by:

- sending a copy of the summons and complaint by registered or certified mail or other public means by which a written acknowledgment of receipt may be requested and obtained to his residence, place of business or employment with return receipt requested and returned showing receipt of the letter; or

- delivering a copy of the summons and complaint to him personally; or

- sending a copy of the summons and complaint by registered or certified mail or other public means by which a written acknowledgment of receipt may be requested and obtained to his residence, place of business or employment with return receipt requested and returned showing receipt of the letter; or

- serving his agent as provided by rule, statute or valid agreement.Copy Service to Be Followed With Mail. Whenever service is made under Clause (3) or (4) of subdivision (A), the person making the service also shall send by first class mail, a copy of the summons without the complaint to the last known address of the person being served, and this fact shall be shown upon the return.

KANSAS

Upon an individual other than a minor or a disabled person, by serving the individual or by serving an agent authorized by appointment or by law to receive service of process, but if the agent is one designated by statute to receive service, such further notice as the statute requires shall be given. Service by certified mail shall be addressed to an individual at the individual’s dwelling house or usual place of abode and to an authorized agent at the agent’s usual or designated address. If service by certified mail to the individual’s dwelling house or usual place of abode is refused or unclaimed, the sheriff, party or party’s attorney seeking service may complete service by certified mail, restricted delivery, by serving the individual at a business address after filing a return on service stating the certified mailing to the individual at such individual’s dwelling house or usual place of abode has been refused or unclaimed and a business address is known for such individual.

KENTUCKY

Service shall be made upon an individual within this Commonwealth; other than an unmarried infant or person of unsound mind, by delivering a copy of the summons and of the complaint (or other initiating document) to him personally or, if acceptance is refused by offering personal delivery to such person, or by delivering a copy of the summons and of the complaint (or other initiating document) to an agent authorized by appointment or by law to receive service of process for such an individual.

LOUISIANA

Personal service is made when a proper officer tenders the citation or other process to the person to be served. Personal service may be made anywhere the officer making the service may lawfully go to reach the person to be served. Domiciliary service is made when a proper officer leaves the citation or other process at the dwelling house or usual place of abode of the person to be served with a person of suitable age and discretion residing in the domiciliary establishment.

MAINE

Upon an individual other than minor or an incompetent person, by delivering a copy of the summons and of the complaint to the individual personally or by leaving copies thereof at the individual’s dwelling house or usual place of abode with some person of suitable age and discretion then residing therein or by delivering a copy of the summons and of the complaint to an agent authorized by appointment or by law to receive service of process, provided that if the agent is one designated by statute to receive service, such further notice as the statute requires shall be given. The court, on motion, upon a showing that service as prescribed above cannot be made with due diligence, may order service to be made by leaving a copy of the summons and of the complaint at the defendant’s dwelling house or usual place of abode; or to be made by publication pursuant to subdivision (g) of this rule, if the court deems publication to be more effective.

MARYLAND

Service of process may be made within this State or, when authorized by the law of this State, outside of this State (1) by delivering to the person to be served a copy of the summons, complaint, and all other papers filed with it; (2) if the person to be served is an individual, by leaving a copy of the summons, complaint, and all other papers filed with it at the individual’s dwelling house or usual place of abode with a resident of suitable age and discretion; or (3) by mailing to the person to be served a copy of the summons, complaint, and all other papers filed with it by certified mail requesting: “Restricted Delivery–show to whom, date, address of delivery.” Service by certified mail under this Rule is complete upon delivery. Service outside of the State may also be made in the manner prescribed by the court or prescribed by the foreign jurisdiction if reasonably calculated to give actual notice.

MASSACHUSETTS

Upon an individual by delivering a copy of the summons and of the complaint to him personally; or by leaving copies thereof at his last and usual place of abode; or by delivering a copy of the summons and of the complaint to an agent authorized by appointment or by statute to receive service of process, provided that any further notice required by such statute be given. If the person authorized to serve process makes return that after diligent search he can find neither the defendant, nor defendant’s last and usual abode, nor any agent upon whom service may be made in compliance with this subsection, the court may on application of the plaintiff issue an order of notice in the manner and form prescribed by law.

MICHIGAN

(1) delivering a summons and a copy of the complaint to the defendant personally; or

(2) sending a summons and a copy of the complaint by registered or certified mail, return receipt requested, and delivery restricted to the addressee. Service is made when the defendant acknowledges receipt of the mail. A copy of the return receipt signed by the defendant must be attached to proof showing service under subrule (A)(2).

MINNESOTA

Upon an individual by delivering a copy to the individual personally or by leaving a copy at the individual’s usual place of abode with some person of suitable age and discretion then residing therein. If the individual has, pursuant to statute, consented to any other method of service or appointed an agent to receive service of summons, or if a statute designates a state official to receive service of summons, service may be made in the manner provided by such statute. If the individual is confined to a state institution, by serving also the chief executive officer at the institution. If the individual is an infant under the age of 14 years, by serving also the individual’s father or mother, and if neither is within the state, then a resident guardian if the infant has one known to the plaintiff, and if the infant has none, then the person having control of such defendant, or with whom the infant resides, or by whom the infant is employed.

MISSOURI

Upon an individual, including an infant or incompetent person not having a legally appointed guardian, by delivering a copy of the summons and petition personally to the individual or by leaving a copy of the summons and petition at the individual’s dwelling house or usual place of abode with some person of the individual’s family over the age of fifteen years, or by delivering a copy of the summons and petition to an agent authorized by appointment or required by law to receive service of process.

MISSISSIPPI

(1) By Process Server. A summons and complaint shall, except as provided in subparagraphs (2) and (4) of this subdivision, be served by any person who is not a party and is not less than 18 years of age. When a summons and complaint are served by process server, an amount not exceeding that statutorily allowed to the sheriff for service of process may be taxed as recoverable costs in the action.

(2) By Sheriff. A summons and complaint shall, at the written request of a party seeking service or such party’s attorney, be served by the sheriff of the county in which the defendant resides or is found, in any manner prescribed by subdivision (d) of this rule. The sheriff shall mark on all summons the date of the receipt by him, and within thirty days of the date of such receipt of the summons the sheriff shall return the same to the clerk of the court from which it was issued.

(3) By Mail.

- (A) A summons and complaint may be served upon a defendant of any class referred to in paragraph (1) or (4) of subdivision (d) of this rule by mailing a copy of the summons and of the complaint (by first-class mail, postage prepaid) to the person to be served, together with two copies of a notice and acknowledgment conforming substantially to Form 1-B and a return envelope, postage prepaid, addressed to the sender.

- (B) If no acknowledgment of service under this subdivision of this rule is received by the sender within 20 days after the date of mailing, service of such summons and complaint may be made in any other manner permitted by this rule.

- (C) Unless good cause is shown for not doing so, the court shall order the payment of the costs of personal service by the person served if such person does not complete and return within 20 days after mailing the notice and acknowledgment of receipt of summons.

- (D) The notice and acknowledgment of receipt of summons and complaint shall be executed under oath or affirmation.

(4) By Publication.

- (A) If the defendant in any proceeding in a chancery court, or in any proceeding in any other court where process by publication is authorized by statute, be shown by sworn complaint or sworn petition, or by a filed affidavit, to be a nonresident of this state or not to be found therein on diligent inquiry and the post office address of such defendant be stated in the complaint, petition, or affidavit, or if it be stated in such sworn complaint or petition that the post office address of the defendant is not known to the plaintiff or petitioner after diligent inquiry, or if the affidavit be made by another for the plaintiff or petitioner, that such post office address is unknown to the affiant after diligent inquiry and he believes it is unknown to the plaintiff or petitioner after diligent inquiry by the plaintiff or petitioner, the clerk, upon filing the complaint or petition, account or other commencement of a proceeding, shall promptly prepare and publish a summons to the defendant to appear and defend the suit. The summons shall be substantially in the form set forth in Form 1-C.

- (B) The publication of said summons shall be made once in each week during three successive weeks in a public newspaper of the county in which the complaint or petition, account, cause or other proceeding is pending if there be such a newspaper, and where there is no newspaper in the county the notice shall be posted at the courthouse door of the county and published as above provided in a public newspaper in an adjoining county or at the seat of government of the state. Upon completion of publication, proof of the prescribed publication shall be filed in the papers in the cause. The defendant shall have thirty (30) days from the date of first publication in which to appear and defend. Where the post office address of a defendant is given, the street address, if any, shall also be stated unless the complaint, petition, or affidavit above mentioned, avers that after diligent search and inquiry said street address cannot be ascertained.

- (C) It shall be the duty of the clerk to hand the summons to the plaintiff or petitioner to be published, or, at his request, and at his expense, to hand it to the publisher of the proper newspaper for publication. Where the post office address of the absent defendant is stated, it shall be the duty of the clerk to send by mail (first class mail, postage prepaid) to the address of the defendant, at his post office, a copy of the summons and complaint and to note the fact of issuing the same and mailing the copy, on the general docket, and this shall be the evidence of the summons having been mailed to the defendant.

- (D) When unknown heirs are made parties defendant in any proceeding in the chancery court, upon affidavit that the names of such heirs are unknown, the plaintiff may have publication of summons for them and such proceedings shall be thereupon in all respects as are authorized in the case of a nonresident defendant. When the parties in interest are unknown, and affidavit of that fact be filed, they may be made parties by publication to them as unknown parties in interest.

- (E) Where summons by publication is upon any unmarried infant, mentally incompetent person, or other person who by reason of advanced age, physical incapacity or mental weakness is incapable of managing his own estate, summons shall also be had upon such other person as shall be required to receive a copy of the summons under paragraph (2) of subdivision (d) of this rule.

(5) Service by Certified Mail on Person Outside State. In addition to service by any other method provided by this rule, a summons may be served on a person outside this state by sending a copy of the summons and of the complaint to the person to be served by certified mail, return receipt requested. Where the defendant is a natural person, the envelope containing the summons and complaint shall be marked “restricted delivery.” Service by this method shall be deemed complete as of the date of delivery as evidenced by the return receipt or by the returned envelope marked “Refused.”

MONTANA

Upon an individual other than an infant or an incompetent person, by delivering a copy of the summons and of the complaint to the individual personally or by delivering a copy of the summons and of the complaint to an agent authorized by appointment or by law to receive service of process, provided that if the agent is one designated by statute to receive service, such further notice as the statute requires shall be given.

NORTH CAROLINA

(1) Natural Person. — Except as provided in subsection (2) below, upon a natural person:

- a. By delivering a copy of the summons and of the complaint to him or by leaving copies thereof at the defendant’s dwelling house or usual place of abode with some person of suitable age and discretion then residing therein; or

- b. By delivering a copy of the summons and of the complaint to an agent authorized by appointment or by law to be served or to accept service of process or by serving process upon such agent or the party in a manner specified by any statute.

- c. By mailing a copy of the summons and of the complaint, registered or certified mail, return receipt requested, addressed to the party to be served, and delivering to the addressee.

NORTH DAKOTA

Upon an individual 14 or more years of age by (i) delivering a copy of the summons to the individual personally; (ii) leaving a copy of the summons at the individual’s dwelling house or usual place of abode in the presence of a person of suitable age and discretion then residing therein; (iii) delivering, at the office of the process server, a copy of the summons to the individual’s spouse if the spouses reside together; (iv) delivering a copy of the summons to the individual’s agent authorized by appointment or by law to receive service of process; or (v) any form of mail or third-party commercial delivery addressed to the individual to be served and requiring a

NEBRASKA

An individual party, other than a person under the age of fourteen years, may be served by personal, residence, or certified mail service.

NEW HAMPSHIRE

All writs and other processes shall be served by giving to the defendant or leaving at his abode an attested copy thereof, except in cases otherwise provided for. Source. RS 183:2. CS 194:2. GS 204:2. GL 223:2. 1883, 22: 1. PS 219:2. 1893, 67:6. PL 331:2. RL 387:2. RSA 510:2. 1971, 179:10, eff. Aug. 10, 1971.

NEW JERSEY

Upon a competent individual of the age of 14 or over, by delivering a copy of the summons and complaint to the individual personally, or by leaving a copy thereof at the individual’s dwelling place or usual place of abode with a competent member of the household of the age of 14 or over then residing therein, or by delivering a copy thereof to a person authorized by appointment or by law to receive service of process on the individual’s behalf;

NEW MEXICO

Upon a competent individual of the age of 14 or over, by delivering a copy of the summons and complaint to the individual personally, or by leaving a copy thereof at the individual’s dwelling place or usual place of abode with a competent member of the household of the age of 14 or over then residing therein, or by delivering a copy thereof to a person authorized by appointment or by law to receive service of process on the individual’s behalf;

NEVADA

In all other cases to the defendant personally, or by leaving copies thereof at his dwelling house or usual place of abode with some person of suitable age and discretion then residing therein, or by delivering a copy of the summons and complaint to an agent authorized by appointment or by law to receive service of process. Details: Eviction notices of all types must be served, First try to personally serve tenant. Second if adult over age 18. Or 3rd By posting on the door. Also Eviction Notices must be served by the constable, sheriff or licensed process server. There is no registered agent option or mention in NRS code.

NEW YORK

Personal service upon the state shall be made by delivering the summons to an assistant attorney-general at an office of the attorney-general or to the attorney-general within the state.

OHIO

(A) Service by certified or express mail. Evidenced by return receipt signed by any person, service of any process shall be by certified or express mail unless otherwise permitted by these rules. The clerk shall place a copy of the process and complaint or other document to be served in an envelope. The clerk shall address the envelope to the person to be served at the address set forth in the caption or at the address set forth in written instructions furnished to the clerk with instructions to forward. The clerk shall affix adequate postage and place the sealed envelope in the United States mail as certified or express mail return receipt requested with instructions to the delivering postal employee to show to whom delivered, date of delivery, and address where delivered. The clerk shall forthwith enter the fact of mailing on the appearance docket and make a similar entry when the return receipt is received. If the envelope is returned with an endorsement showing failure of delivery, the clerk shall forthwith notify, by mail, the attorney of record or, if there is no attorney of record, the party at whose instance process was issued and enter the fact of notification on the appearance docket. The clerk shall file the return receipt or returned envelope in the records of the action. All postage shall be charged to costs. If the parties to be served by certified or express mail are numerous and the clerk determines there is insufficient security for costs, the clerk may require the party requesting service to advance an amount estimated by the clerk to be sufficient to pay the postage.

(B) Personal service. When the plaintiff files a written request with the clerk for personal service, service of process shall be made by that method. When process issued from the Supreme Court, a court of appeals, a court of common pleas, or a county court is to be served personally, the clerk of the court shall deliver the process and sufficient copies of the process and complaint, or other document to be served, to the sheriff of the county in which the party to be served resides or may be found. When process issues from the municipal court, delivery shall be to the bailiff of the court for service on all defendants who reside or may be found within the county or counties in which that court has territorial jurisdiction and to the sheriff of any other county in this state for service upon a defendant who resides in or may be found in that other county. In the alternative, process issuing from any of these courts may be delivered by the clerk to any person not less than eighteen years of age, who is not a party and who has been designated by order of the court to make service of process. The person serving process shall locate the person to be served and shall tender a copy of the process and accompanying documents to the person to be served. When the copy of the process has been served, the person serving process shall endorse that fact on the process and return it to the clerk, who shall make the appropriate entry on the appearance docket. When the person serving process is unable to serve a copy of the process within twenty-eight days, the person shall endorse that fact and the reasons therefor on the process and return the process and copies to the clerk who shall make the appropriate entry on the appearance docket. In the event of failure of service, the clerk shall follow the notification procedure set forth in division (A) of this rule. Failure to make service within the twenty-eight day period and failure to make proof of service do not affect the validity of the service.

(C) Residence service. When the plaintiff files a written request with the clerk for residence service, service of process shall be made by that method. Residence service shall be effected by leaving a copy of the process and the complaint, or other document to be served, at the usual place of residence of the person to be served with some person of suitable age and discretion then residing therein. The clerk of the court shall issue the process, and the process server shall return it, in the same manner as prescribed in division (B) of this rule. When the person serving process is unable to serve a copy of the process within twenty-eight days, the person shall endorse that fact and the reasons therefor on the process, and return the process and copies to the clerk, who shall make the appropriate entry on the appearance docket. In the event of failure of service, the clerk shall follow the notification procedure set forth in division (A) of this rule. Failure to make service within the twenty-eight-day period and failure to make proof of service do not affect the validity of service. [Adopted eff. 7-1-70; amended eff. 7-1-71, 7-1-80, 7-1-97]

OKLAHOMA

At the election of the plaintiff, process, other than a subpoena, shall be served by a sheriff or deputy sheriff, a person licensed to make service of process in civil cases, or a person specially appointed for that purpose. The court shall freely make special appointments to serve all process, other than a subpoena, under this paragraph.Service shall be made as follows:

- Upon an individual other than an infant who is less than fifteen (15) years of age or an incompetent person, by delivering a copy of the summons and of the petition personally or by leaving copies thereof at the person’s dwelling house or usual place of abode with some person then residing therein who is fifteen (15) years of age or older or by delivering a copy of the summons and of the petition to an agent authorized by appointment or by law to receive service of process;

OREGON

- Personal service. Personal service may be made by delivery of a true copy of the summons and a true copy of the complaint to the person to be served.

- Substituted service. Substituted service may be made by delivering a true copy of the summons and the complaint at the dwelling house or usual place of abode of the person to be served, to any person 14 years of age or older residing in the dwelling house or usual place of abode of the person to be served. Where substituted service is used, the plaintiff, as soon as reasonably possible, shall cause to be mailed, by first class mail, a true copy of the summons and the complaint to the defendant at defendant’s dwelling house or usual place of abode, together with a statement of the date, time, and place at which substituted service was made. For the purpose of computing any period of time prescribed or allowed by these rules or by statute, substituted service shall be complete upon such mailing.

- Office service. If the person to be served maintains an office for the conduct of business, office service may be made by leaving a true copy of the summons and the complaint at such office during normal working hours with the person who is apparently in charge. Where office service is used, the plaintiff, as soon as reasonably possible, shall cause to be mailed, by first class mail, a true copy of the summons and the complaint to the defendant at the defendant’s dwelling house or usual place of abode or defendant’s place of business or such other place under the circumstances that is most reasonably calculated to apprise the defendant of the existence and pendency of the action, together with a statement of the date, time, and place at which office service was made. For the purpose of computing any period of time prescribed or allowed by these rules or by statute, office service shall be complete upon such mailing.

- Service by Mail.

- Generally. When required or allowed by this rule or by statute, except as otherwise permitted, service by mail shall be made by mailing a true copy of the summons and the complaint to the defendant by first class mail and by any of the following: certified or registered mail, return receipt requested, or express mail. For purposes of this section, first class mail does not include certified or registered, or any other form of mail which may delay or hinder actual delivery of mail to the addressee.

PENNSYVANIA

Original process may be served upon a defendant who is an adult

- by handing a copy to the defendant; or

- by handing a copy

- at the residence of the defendant to an adult member of the family with whom the defendant resides; but if no adult member of the family is found, then to an adult person in charge of such residence; or

- at the hotel, inn, apartment house, boarding house or other place of lodging at which the defendant resides to the manager or other person authorized to accept deliveries of United States mail; or

- at any office or usual place of business of the defendant to the defendant’s agent or to the person for the time being in charge.

RHODE ISLAND

Upon an individual from whom a waiver has not been obtained and filed other than an incompetent person, by delivering a copy of the summons and complaint to the individual personally or by leaving copies thereof at the individual’s dwelling house or usual place of abode with some person of suitable age and discretion then residing therein or by delivering a copy of the summons and complaint to an agent authorized by appointment or by law to receive service of process, provided that if the agent is one designated by statute to receive service, such further notice as the statute requires shall be given.

SOUTH CAROLINA

Upon an individual other than a minor under the age of 14 years or an incompetent person, by delivering a copy of the summons and complaint to him personally or by leaving copies thereof at his dwelling house or usual place of abode with some person of suitable age and discretion then residing therein, or by delivering a copy to an agent authorized by appointment or by law to receive service of process.

SOUTH DAKOTA

The summons shall be served by delivering a copy thereof to the defendant personally.

TENNESSEE

Upon an individual other than an unmarried infant or an incompetent person, by delivering a copy of the summons and of the complaint to the individual personally, or if he or she evades or attempts to evade service, by leaving copies thereof at the individual’s dwelling house or usual place of abode with some person of suitable age and discretion then residing therein, whose name shall appear on the proof of service, or by delivering the copies to an agent authorized by appointment or by law to receive service on behalf of the individual served.

TEXAS

Unless the citation or an order of the court otherwise directs, the citation shall be served by any person authorized by Rule 103 by

- delivering to the defendant, in person, a true copy of the citation with the date of delivery endorsed thereon with a copy of the petition attached thereto, or

- mailing to the defendant by registered or certified mail, return receipt requested, a true copy of the citation with a copy of the petition attached thereto.

Upon motion supported by affidavit stating the location of the defendant’s usual place of business or usual place of abode or other place where the defendant can probably be found and stating specifically the facts showing that service has been attempted under either (a)(I) or (a)(2) at the location named in such affidavit but has not been successful, the court may authorize service

- (1) by leaving a true cope of the citation, with a copy of the petition attached, with anyone over sixteen years of age at the location specified in such affidavit, or

- in any other manner that the affidavit or other evidence before the court shows will be reasonably effective to give the defendant notice of the suit. (Amended Aug. 18, 1947, eff. Dec. 31, 1947; July 22, 1975, eff. Jan. 1, 1976; July 11, 1977, eff. Jan. 1, 1978, June 10, 1980, eff. Jan. 1, 1981; July 15, 1987, eff. Jan. 1, 1988; April 24, 1990, eff. Sept. 1, 1990.)

UTAH

Upon any individual by delivering a copy of the summons and/or the complaint to the individual personally, or by leaving a copy at the individual’s dwelling house or usual place of abode with some person of suitable age and discretion there residing, or by delivering a copy of the summons and/or the complaint to an agent authorized by appointment or by law to receive service of process.

VIRGINIA

By delivering a copy thereof in writing to the party in person; or

By substituted service in the following manner:

- If the party to be served is not found at his usual place of abode, by delivering a copy of such process and giving information of its purport to any person found there, who is a member of his family, other than a temporary sojourner or guest, and who is of the age of sixteen years or older; or

- If such service cannot be effected under subdivision 2 a, then by posting a copy of such process at the front door or at such other door as appears to be the main entrance of such place of abode, provided that not less than ten days before judgment by default may be entered, the party causing service or his attorney or agent mails to the party served a copy of such process and thereafter files in the office of the clerk of the court a certificate of such mailing. In any civil action brought in a general district court, the mailing of the application for a warrant in debt or affidavit for summons in unlawful detainer or other civil pleading or a copy of such pleading, whether yet issued by the court or not, which contains the date, time and place of the return, prior to or after filing such pleading in the general district court, shall satisfy the mailing requirements of this section. In any civil action brought in a circuit court, the mailing of a copy of the pleadings with a notice that the proceedings are pending in the court indicated and that upon the expiration of ten days after the giving of the notice and the expiration of the statutory period within which to respond, without further notice, the entry of a judgment by default as prayed for in the pleadings may be requested, shall satisfy the mailing requirements of this section and any notice requirement of the Rules of Court. Any judgment by default entered after July 1, 1989, upon posted service in which proceedings a copy of the pleadings was mailed as provided for in this section prior to July 1, 1989, is validated.

- The person executing such service shall note the manner and the date of such service on the original and the copy of the process so delivered or posted under subdivision 2 and shall effect the return of process as provided in \u00a7\u00a7 8.01-294 and 8.01-325.

VERMONT

Upon an individual by delivering a copy of the summons and of the complaint to the individual personally or by leaving copies thereof at the individual’s dwelling house or usual place of abode with some person of suitable age and discretion then residing therein or by delivering a copy of the summons and of the complaint to an agent authorized by appointment or by law to receive service of process, provided that if the agent is one designated by statute to receive service, such further notice as the statute requires shall be given. The court, on motion, upon a showing that service as prescribed above cannot be made with due diligence, may order service to be made by leaving a copy of the summons and of the complaint at the defendant’s dwelling house or usual place of abode, or to be made by publication pursuant to subdivision (g) of this rule, if the court deems publication to be more effective. If the individual is an infant or incompetent person, process may be served upon the individual by one of the foregoing methods, or as follows:

- Upon an infant by delivering a copy of the summons and of the complaint personally (a) to the infant and (b) also to the infant’s guardian if the infant has one within the state, known to the plaintiff, and if not, then the infant’s father or mother or other person having the infant’s care or control, or with whom the infant resides, or if service cannot be made upon any of them, then as provided by order of the court.

- Upon an incompetent person by delivering a copy of the summons and of the complaint personally (a) to the guardian of that person or a competent adult member of that person’s family with whom that person resides, or if that person is living in an institution, then to the director or chief executive officer of the institution, or if service cannot be made upon any of them, then as provided by order of the court and (b) unless the court otherwise orders, also to the incompetent.

WASHINGTON

A notice of appearance, if made, shall be in writing, shall be signed by the defendant or his attorney, and shall be served upon the person whose name is signed on the summons. In condemnation cases a notice of appearance only shall be served on the person whose name is signed on the petition.

WISCONSIN

Any subpoena may be served by any person by exhibiting and reading it to the witness, or by giving the witness a copy thereof, or by leaving such copy at the witness’s abode.

WEST VIRGINIA

Personal or substituted service shall be made in the following manner:

- Delivering a copy of the summons and complaint to the individual personally; or

- Delivering a copy of the summons and complaint at the individual’s dwelling place or usual place of abode to a member of the individual’s family who is above the age of sixteen (16) years and by advising such person of the purport of the summons and complaint; or

- Delivering a copy of the summons and complaint to an agent or attorney-in-fact authorized by appointment or statute to receive or accept service of the summons and complaint in the individual’s behalf; or

- The clerk sending a copy of the summons and complaint to the individual to be served by certified mail, return receipt requested, and delivery restricted to the addressee; or

- The clerk sending a copy of the summons and complaint to the individual to be served by certified mail, return receipt requested, and delivery restricted to the addressee;

WYOMING

The summons and complaint shall be served together. The plaintiff shall furnish the person making service with such copies as are necessary.

Definition of Service of Due Process

First of all, service of due process is a privilege set forth by the Constitution. This means that all citizens of the United States hold the right to be informed of being summoned as specified in the fifth and sixth amendments of the Constitution. A process server is the messenger who “serves” a person with the notification that states the legal issues involved in a lawsuit. A process server delivers these papers in a timely manner and then there is verification a defendant was served the Summons and Complaint.

Tags:

Eviction Information,

Process Service News

Your lease is the contract between you and your tenant. For any contract to work and be legal, certain clauses are necessary. If these clauses are left out or are poorly written, the the landlord runs the risk of serious problems in the future. This post describes several clauses every lease should contain.

Your lease is the contract between you and your tenant. For any contract to work and be legal, certain clauses are necessary. If these clauses are left out or are poorly written, the the landlord runs the risk of serious problems in the future. This post describes several clauses every lease should contain.