The eviction moratorium has ended, but another one kicks in. Here’s what it means by NationalEvictions

The eviction moratorium has ended, but another one kicks in. Here’s what it means

One national ban on evictions came to an end Thursday, but another moratorium is ready to take its place Friday.

The Centers for Disease Control and Prevention issued a moratorium Sept. 4 on all evictions and foreclosures around the U.S., citing health risks and the possibility of further spread of the COVID-19 virus because of homelessness.

The CDC moratorium expired at 11:59 p.m. Dec. 31.

In its place comes another eviction moratorium, part of the $900 billion bipartisan stimulus package passed by Congress and signed by President Donald Trump on Dec. 27. The 5,600-page bill allocates $25 billion in rental relief funds for renters and landlords. The bill stretches the eviction moratorium until Jan. 31. The money will be sent to states to distribute.

According to the National Low Income Housing Coalition, Florida will receive $1.43 billion in rent relief funds. The money is earmarked for households making 80% or less of the area’s median income. (In Miami-Dade, a household of four people would need to earn $73,210 or less to qualify. A household of one person would need to earn $51,200 or less.)

The funds come as a relief for the “mom and pop” landlords — individual investors — who own 41% of the total 48.2 million rental units in the U.S., according to the U.S. Department of Housing and Urban Development.

“My initial read of the legislation is that landlords will [also] be able to apply on behalf of landlords,” said Jilliene Helman, CEO and founder of RealtyMogul, the online crowdfunding marketplace for real estate, with a $2.3 billion portfolio of 15,000 multifamily units. In the previous stimulus package, tenants had to apply for financial assistance themselves and obtain a W-9 form from their landlords.

“We’ve been working with our tenants to come up with payment plans and keep people with their homes,” Helman said. “That’s one thing landlords can do. There are a lot of programs with rental assistance and we’ve struggled with our tenants to apply for them. The fact that landlords can now apply for them is really fantastic.”

Miami-Dade has had trouble distributing the $474 million in federal CARES Act relief funds approved earlier this year. The act was passed in March to provide direct economic assistance for homeowners and small businesses impacted by the pandemic.

But as of Dec. 30, the deadline for applications, the county was still scrambling to get the money out to renters, small business owners and families in need. The application process is now closed.

The new bill gives the county another year to distribute the COVID relief funds, through direct relief programs or disbursing money to municipalities. The mechanism to distribute that money has not yet been established.

High risk of eviction

According to a new study byAdvisorSmith, an insurance analytics firm, Floridians have the second highest rate of eviction risk in the country, with 15.6% of renters behind on rent payments. The study uses data from the U.S. Census Bureau.

An estimated 452,928 households in Miami-Dade are renter occupied, according to the Census.

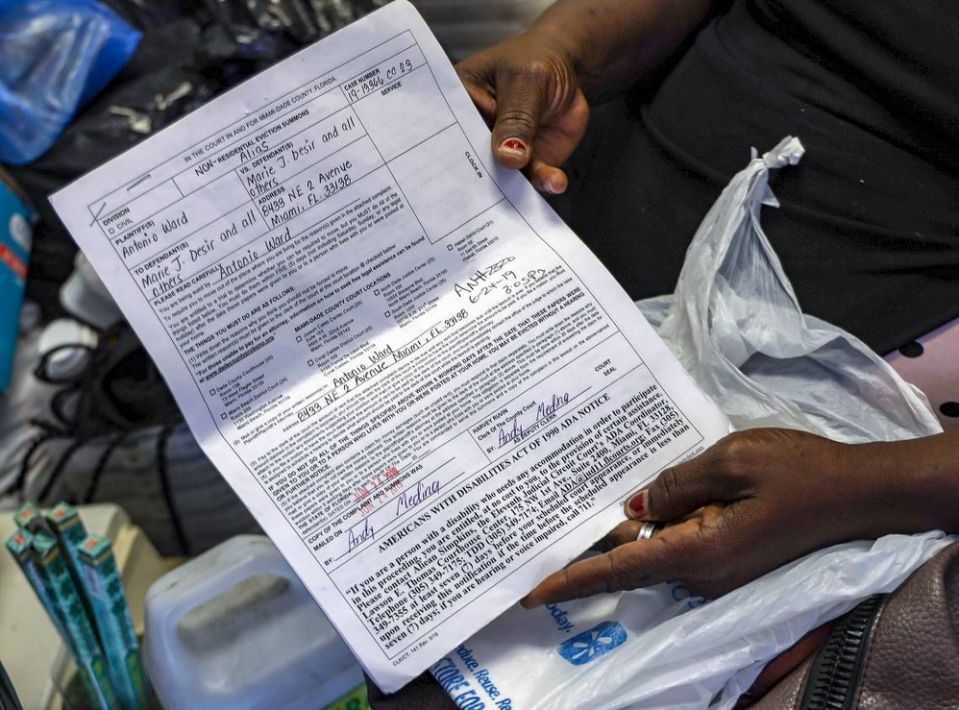

According to the Miami-Dade Clerk of Courts, a total of 4,535 evictions have been filed in the county from Sept. 1 to Dec. 22. A total of 1,890 Writs of Possession — the final judgment in the eviction process which allows the landlord to seize their property and physically remove the tenant — were issued between March 13 and Dec. 22.

Nearly all the Writs of Possession are for tenants who simply stopped paying their rent and refuse to leave the property.

But because the Miami-Dade Police Department, the only legal authority that can serve a Writ of Possession, still has a moratorium on carrying out evictions filed after March 13, none of the Writs have been served.

Helman, who estimates the loss in unpaid rent in the U.S. at $70 billion, said that cities will be able to maintain a moratorium on eviction proceedings as long as they want.

“Los Angeles is talking about December 2021 before they resume evictions,” she said.

Talk to your landlord

In the meantime, some landlords are working things out with their tenants, through payment plans or forgiving late rents in exchange for making improvements on the property.

Bob Powers owns a four-unit apartment building on 66th Street and Biscayne Boulevard. Because he lives in one of the units, the property is homestead exempted, which cuts him a break on property taxes. But it also bars him from receiving federal aid to cover his unpaid rents, which run from $1,000-$1,400 per month.

“Could I have lied and gotten relief? Yes,” Powers said. “But I wasn’t about to do that. You can murder people in the U.S. and get away with it, but don’t mess with the IRS. They got Al Capone that way and they’re going to get the president that way.”

Armando Alfonso, a Miami attorney who represents both landlords and tenants, said the number of evictions he has processed has gone from eight in May to just one. He said that’s a sign that landlords are continuing to work out payment plans with their renters, but that type of arrangement won’t last forever.

“The solution has to come from the federal level,” he said. ”You draft something halting evictions and recommend the states adopt this. Private property is handled on a state level. But you also want to do something for the landlords where there’s a moratorium on mortgages. You have a moratorium on property taxes owed. You have to issue a moratorium on utilities.

“The government is recognizing the problem that we can’t evict these people, but we have to do something to help the landlords, too,” he said. “How do we help these mom-and-pops so they don’t get foreclosed on? No one is going to win when the bank forecloses on all these homes.”

Tags: Eviction Information, Florida Eviction Articles